- Home → Industries → Banking and Finance

Toronto Web Services for Banking and Finance

Marquee, Robertson, WoodGundy (Allen), FMI, Finance Interview Coach, John?, Fintech?

Home → Industries → Banking and Finance

Our team has the professional experience and … delivering solutions for

- Our Experience

Working with some of the leading canadian financial institutions.

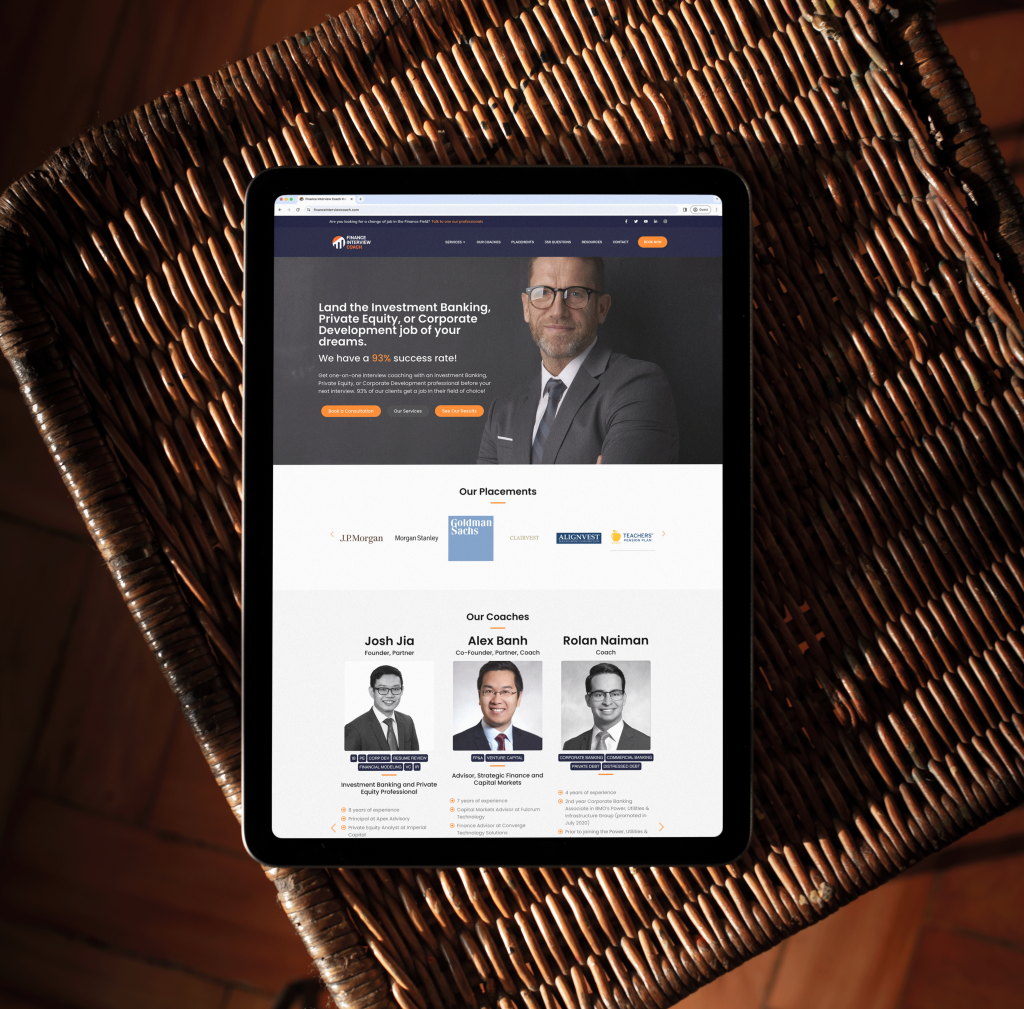

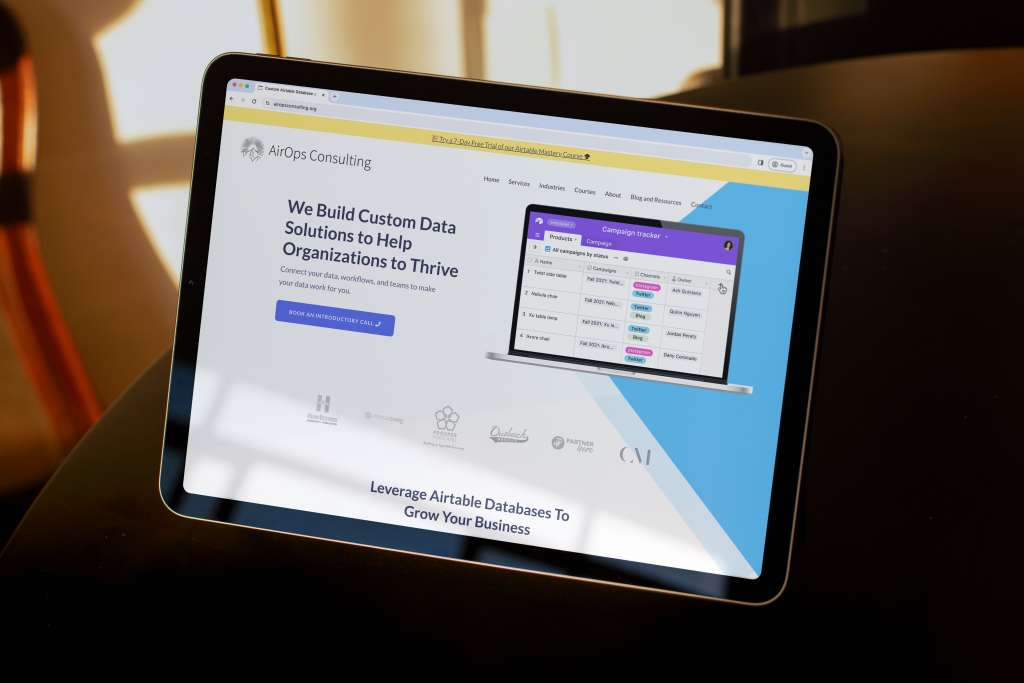

Businesses training, management consulting in the finance industry.

Navigate organizational change smoothly and ensure successful implementation.

Training Providers, Financial Recruiters, and other professional businesses that serve the finance industry.

Our partners with leading technology providers to guide our clients through the implementation process.

- Our Capabilities

Efficient Execution & Seize Opportunities

Portfolio Management

With an expansive investment opportunity set encompassing stocks, bonds, real estate, and commodities, our commitment to effective diversification extends beyond capital allocation across diverse asset classes. We also meticulously diversify across various economic and market risk factors, ensuring a resilient and well-rounded investment approach.

Asset Allocation

With a vigilant eye, we continuously monitor the relative performance and valuation of diverse asset classes amid the ever-changing global economic landscape. Our approach involves making dynamic allocation decisions, informed by perceived opportunities and risks across various investment domains.

Risk Management

As a part of our holistic approach, we place a strong emphasis on conducting thorough risk assessments and implementing effective risk mitigation strategies, which include insurance solutions and various other tactics. By diligently evaluating and addressing potential financial risks, we aim to provide you with a secure and stable financial foundation, safeguarding your wealth and future aspirations.

Client results

Explore our success stories to see how we have helped businesses like yours overcome challenges and achieve tangible results.

Our process

Getting to Know You

Prior to formal engagement, we prioritize understanding your personal situation, financial goals, and key concerns that drive your search for financial advice. This forms the basis for a mutually agreed-upon scope of work. Please find below a comprehensive list of our capabilities.

Gaining Clarity on Your Finances

Our comprehensive planning engagements start by jointly assessing your balance sheet and cash flow. Access our secure client portal to upload documents or link your accounts electronically.

Building Your Financial Vision

We collaborate with you to prioritize your goals and assess the financial choices and risks involved in achieving them. Through close partnership, we establish a baseline projection of your future financial wealth, providing a roadmap for your success.

Analyzing Tradeoffs

We use our financial model to develop alternative scenarios, informing recommendations on taxes, insurance, and investments to align with your goals. Exploring scenarios to align recommendations.

We are here to address any questions you may have as you implement your plan. Additionally, for clients seeking an ongoing partnership, we provide comprehensive Tax & Estate planning.